Roi formula property

ROI Income from Investment Cost of InvestmentCost of Investment. To understand whether this is a good investment you want to know your ability to earn a profit on this property.

Quick Flip Quick Tip Calculating Roi Net Profits In Real Estate Youtube

In this case you would have a 22 percent ROI on your property.

. This means that we have an annual return of 501684 41807 x 12 months. It uses fairly general numbers and is not. The reason for this is that the ROI formula shown above assumes that the property is sold at the end of the specific period it is calculated for.

ROI Final value of investment - Initial value of investment Cost of investment x 100. As you can see this is a very simple ROI formula. Identify and then subtract the final value of the investment by its initial value.

Lets say your income on a property was 20000 and you spent 5000. You can just find a rental property calculator for that. Your ROI is calculated with the following formula.

Here is a simple formula for determining the ROI of an office building you have purchased. ROI investment gain investment cost investment cost. Identify the initial value of the investment.

Here is what the formula looks like. ROI Net Return On InvestmentCost of Investment X 100. This is how to calculate ROI for this investment property.

The resulting number you get from this entry will return you a figure such as 22 which you then convert into a percentage by multiplying by 100. You can directly calculate ROI using just two cell columns Investment Amount and Total Return using the formula. Sign Up For A Free Trial.

When determining the earning you gained on your rental investment dont forget. Based on this definition we understand that the ROI formula is. This is a very simple rate of return formula and utilizes an estimation of your investment and gains.

Your ROI is 300. That rate of return formula is. RETURNS EXPENSES EXPENSES ROI.

The rate of return on your investment is. And charge your tenants a monthly rent of 2500. ROI Gain on investment Cost of investment Cost of investment You can invest in real estate using all cash or by financing the property.

For example lets say you invested 100000 in the rental property and the total profits made from the investment is 120000. Your formula calculation would be 14400 210000 0068 or 68 ROI Since ROI is a profitability ratio it must be represented as a percent. ROI Gain on investment Cost of investment Cost of investment.

Lets look at the ROI for a cash purchase and a financed purchase using our 100000 in capital. ROI net profits investment cost. ROI for cash transactions Calculating the ROI for a rental property is easiest when you pay for.

At the time of purchase the property value of your home was appreciated at 300000. Ad The Ultimate Real Estate Software For Investors Realtors Brokers. Even if a rental property has positive cash flow it is possible for its return on investment to be negative in the first few years of ownership.

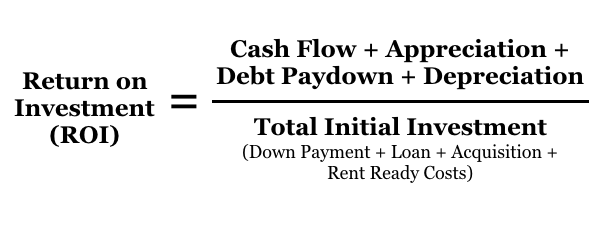

Return on investment ROI is a metric that helps real estate investors evaluate whether they should buy an investment property and compare apples to apples one investment to another. ROI on a real estate rental property is calculated using the following formula. Smart Real Estate Software For Investors Realtors Brokers.

For example assume youve bought an income property for 400000 paid another 15000 in closing fees rehab costs etc. After calculating your net profit divide it by the original cost of the rental investment property. Every real estate investor should know the essential rate of return formula in order to determine the ROI on their rental property.

You can invest in real estate using all cash or by financing the property. Calculating ROI isnt the hard part. Why ROI Can Be Negative During the First Few Years.

And while the math is simple getting the numbers to plug into this. ROI allows investors to predict based on comparables the profit margin they should realize on their real estate either through flipping homes or renting properties. Now in order to calculate the propertys ROI were going to divide the annual return by our original out-of-pocket expenses the downpayment of.

ROI 12 x 2500 400000 15000 x 100. ROI investment gain - cost of investment cost of investment. Calculating ROI isnt that hard.

Calculating Returns For A Rental Property Xelplus Leila Gharani

How Do You Calculate Return On Investment On Rental Property

How To Calculate Roi For A Potential Real Estate Investment Excelsior Capital

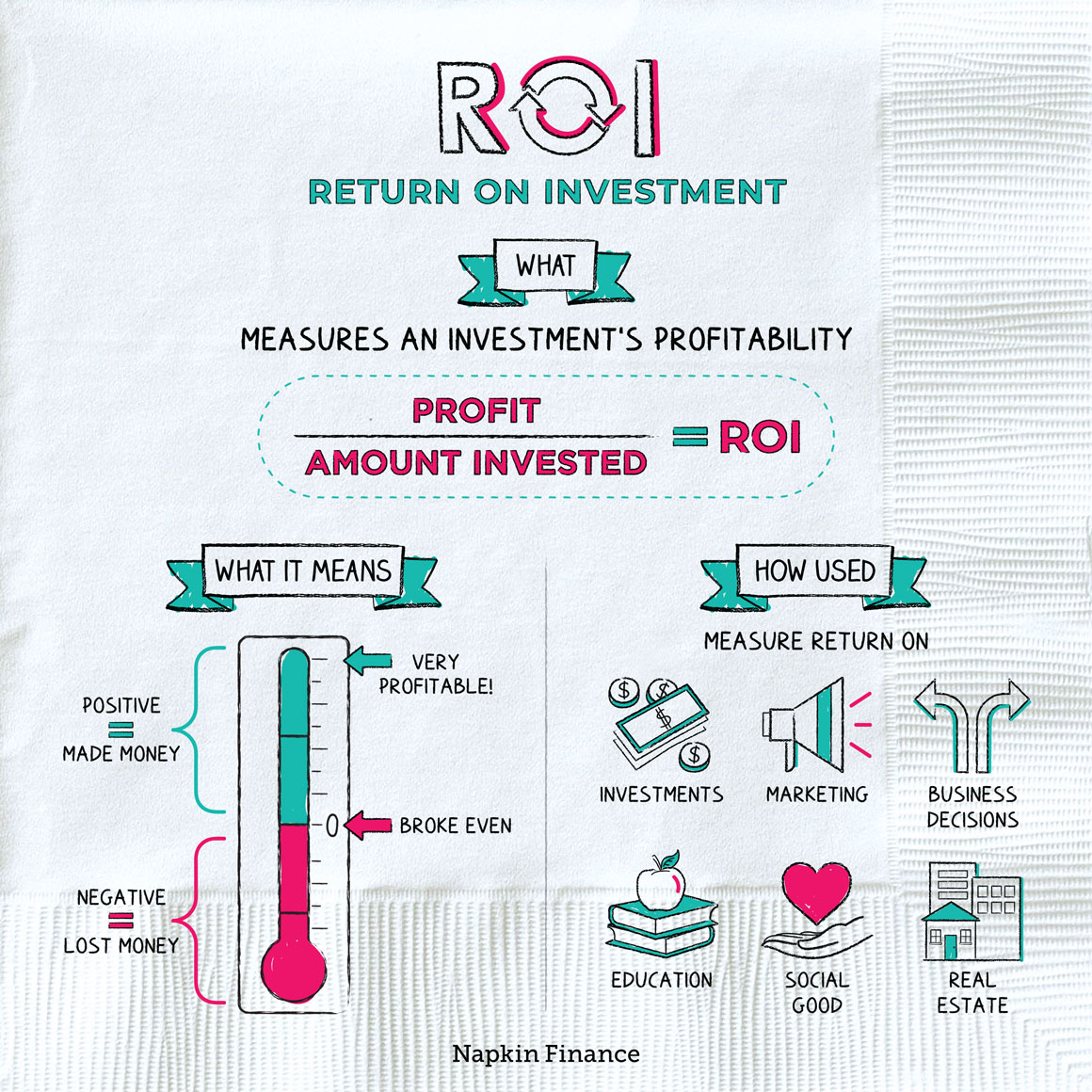

Roi Formula Calculate Roi And More From Napkin Finance

4 Ways Passive Investors Can Calculate Roi In Real Estate

5 Easy Ways To Measure The Roi Of Training

How To Calculate Roi On Rental Property Rapid Property Connect

How To Calculate Roi On Rental Property Rapid Property Connect

How To Calculate Roi On Spanish Rental Property

4 Ways Passive Investors Can Calculate Roi In Real Estate

How To Increase Roi On A Rental Property Mashvisor

Rental Property Cash On Cash Return Calculator Invest Four More

How To Calculate Roi On Spanish Rental Property

What Is A Good Return On Investment For Rental Properties Mashvisor

Return On Equity Denver Investment Real Estate

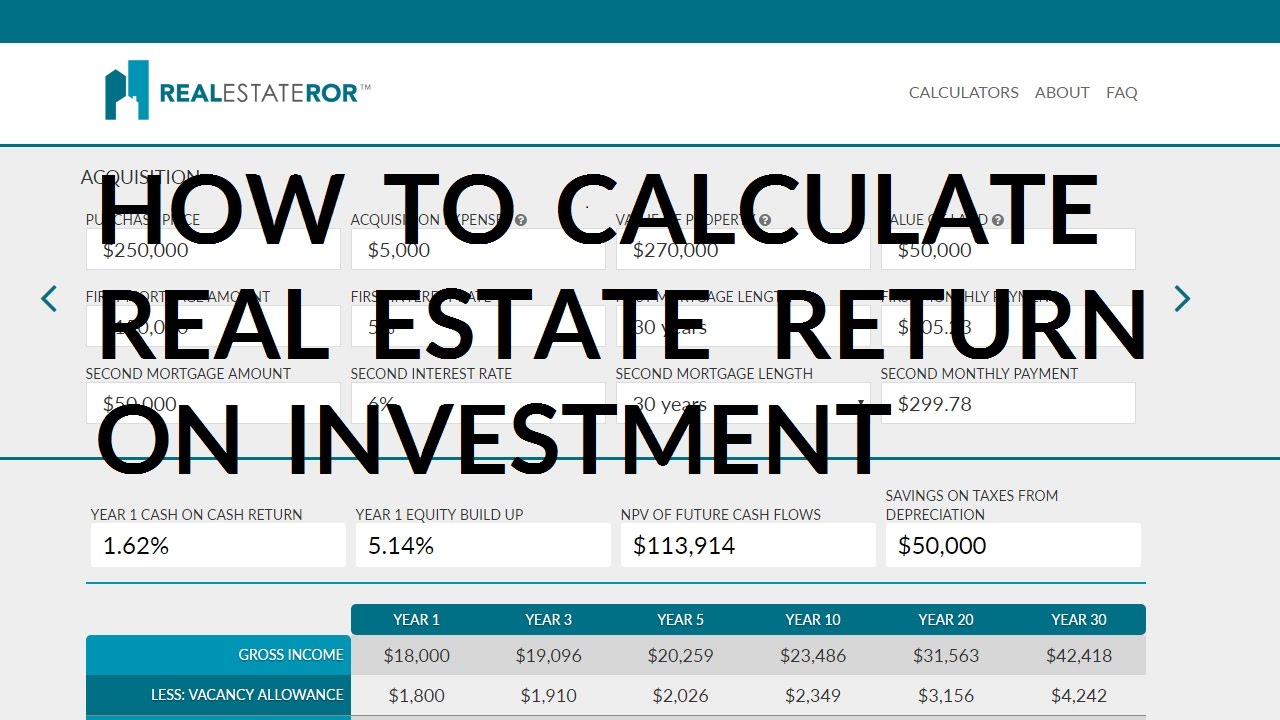

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

Roi In Real Estate How To Calculate Roi On Property 99acres